THE GROWING PREVALENCE OF AGRI-TECH IN AGRICULTURE IN AFRICA

INTRODUCTION

Agriculture in Africa is a bit of a contradiction. Africa has 60% – 65% of the world’s uncultivated arable land; it can feed the world. However, while a country such as the Democratic Republic of the Congo (DRC) can feed Africa’s population of 1.3 billion, it struggles to feed its population of approximately 90 million.

The continent imports food of US$41 billion net annually. This figure will reportedly grow to US$110 billion by 2025. Farmers in Africa are, on average, between 50 and 63 years old, depending on whom you ask, while 85% of farming activity takes place on smallholder plots of 2 – 3 hectares each. The youth of Africa are migrating from their farms to the urban areas to find a better-paying job rather than struggle as their parents did. Unfortunately, many eventually find themselves unemployed and disillusioned, living in corrugated iron and wood shacks. Some also migrate to Europe.

Approximately 60% of Africa’s population works in the agriculture sector, while the sector contributes 25% to Africa’s GDP.

There are several reasons for the poor productivity of Africa’s agricultural sector. Smallholder plot sizes limit harvest sizes. The absence of modern irrigation techniques, poor transport infrastructure, absence of modern farming practices, no knowledge of market needs and marketing practices, absence of financing, aged farmers, lack of political will to change, poor supply chain channels and the absence of cold chain facilities, and high post-harvest losses contribute towards the high food import figure. Governmental policies pulling out all stops to remain in power and ignoring the challenges in the agriculture sector have aggravated this situation.

It is, therefore, necessary to industrialize and commercialize agriculture. Furthermore, the agriculture sector must increase its productivity and attract the youth by improving its image and making it “sexy.” Currently, the youth is only involved in marketing and sales, not the farms’ hard side.

Developed nations use artificial intelligence, blockchain, machine learning, and robots to solve agricultural challenges. In Africa, simple, mobile phone-based offerings could produce great results.[i]

Stakeholders in the sector are embracing digital technologies to make farming more attractive. These technologies can transform Africa. In addition, technology facilitates involvement in the various sub-sectors of the agriculture industry, for investors, suppliers, farmers, and markets. Hopefully, these initiatives will help the farmers address the challenges and constraints they experience and attract the youth to move back into the sector. Below are several initiatives based on digital technology, all aiming to support Africa’s farmers in various ways. However, not all of them have succeeded.

In 2020, agri-tech startups in Africa raised ±US$60 million, which is about 8.6% of the funding obtained by tech startups in 2020. They use technologies like drones, automated irrigation, and soil sensors and set up digital systems to help farmers access markets, inputs, insurance, financing, and knowledge.[ii]

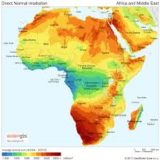

The two figures below indicate the nature of active digital agriculture services and where they are the most active.

According to a 2019 African Development Bank report, 54% of all digital agricultural solutions were still used by commercial agribusinesses, with many services unaffordable to small-scale farmers.[iii]

According to the Technical Centre for Agricultural and Rural Cooperation (TCA), quoted by an Oxford Group report,[iv] smart and precision farming used IoT to leverage drones and sensors to monitor and improve the productivity of crops, livestock, and aquaculture. As stated by GMSA, the challenge was that Africa has few scalable IoT networks. At the same time, many farmers operate on too small a scale to make many of the services commercially viable. Of the 390 active digital agricultural solutions in Africa in 2019, 60% were launched after 2016, and 20% since 2018.

Over 33 million smallholder farmers have used at least one of these services, while 70% of service providers generate revenue. Most smallholder farmers, however, need help to afford these services. While the market revenue is only US$143 million, the potential market revenue in this area is enormous, ranging between US$2.6 billion and US$6 billion.[v] This trend reflects a growing interest from a rising domestic middle class and an African diaspora looking for alternative investment opportunities.

Figure 1: Active Digital Agriculture Services in Sub-Saharan Africa

(Source: Oxford Business Group, in collaboration with OCP: https://oxfordbusinessgroup.com/sites/default/files/blog/specialreports/960469/OCP_Agriculture_Africa_Report_2021.pdf)

Figure 2: Top Five Countries by Number of Digital Agriculture Services, January 2020

(Source: Oxford Business Group, in collaboration with OCP: https://oxfordbusinessgroup.com/sites/default/files/blog/specialreports/960469/OCP_Agriculture_Africa_Report_2021.pdf)

The consolidation of information systems within African markets has been recommended to predict annual consumer demand. However, this information is unavailable, potentially flooding the market with unwanted products and subsequent food waste or scarcity that increases food prices.

There are a few positive trends that can increase entrepreneurial agriculture activity. The growth of retail supermarkets in Africa has increased the number of medium-scale entrepreneurial farmers (between 5 and 100ha), and there is a growing demand for prepared foods. Restaurants are using local ingredients because of rapid urbanization. Finally, the rise of agri-tech can increase access to inputs, knowledge, productivity, and markets.[vi]

Africa hosts 25% of the world’s farmland but generates only 10% of global crops. As most smallholder farmers operate at just 40% of their potential capacity due to a lack of access to funding, it leads to a vicious cycle that suppresses the productivity of Africa’s farmers. Moreover, low crop yields deny these farmers the collateral for loans at financial institutions. However, tech startups contribute to the growth of Africa’s agricultural potential.[vii]

In the sections below, this report will briefly discuss a few of the agri-tech platforms available in Africa. The purpose of the information is to show examples of the growing prevalence of agri-tech applications in Africa’s agriculture sector.

AGRI-TECH IN AFRICA

Emerging agri-tech applications (apps) promise to restructure Africa’s agricultural value chains. These apps are either responses to pandemic-related lockdowns and the need for social distancing or to address the challenges created by years of underinvestment in Africa’s agriculture sector.

However, these innovations face several problems:

- Input shortages negatively affect the planting and harvesting seasons

- Vague land rights and increasing foreign ownership of prime agriculture land

- Lack of access to funded farms for investors to check on the progress of investments

- Land held under customary land tenant systems, without legal protection through title deeds, making investors cautious about investing in developing the land

The potential to help farmers scale operations in the long term is a significant benefit of these apps. Some agri-tech app operators are exploring the potential to expand beyond their original borders.[viii]

Agrimatic in Egypt

Agrimatic is an aquaponic agriculture company founded in 2014 in Egypt. The company deals with challenges brought about by factors such as a rapidly growing global population, limited arable land, climate change, and lagging agricultural development, all contributing to food insecurity.

Agrimatic provides clean agricultural produce by growing fish and plants in a closed system typically found in nature. The plants feed off the treated waste of the fish. Agrimatic produces several fish species and grows plant products like arugula, basil, and lettuce. It aims to address global hunger through higher productivity and soil-less technology to ensure food security and sustainability.[ix]

D4Ag: Boosting Digital Start-Up Scene in Africa

The Digital4Agriculture program (D4Ag) is an initiative of the German Society for International Cooperation (GIZ) within the framework of the project “Make-IT in Africa.” The goal of D4AG is to promote the digital startup scene of developing and emerging countries. It does so together with (primarily) European technology companies, startups, associations, research & science, and non-governmental organizations.

IBM joined the Make-IT Alliance in 2017. It will support the D4AG by providing access to weather information and services to Africa’s smallholder farmers to help them better manage and improve their crops, production, and long-term living conditions. With IBM’s digital expertise, D4Ag assists over 36 African agricultural companies in 13 countries to prepare for the digital future.

The project aims at helping local startups reach more customers and develop new markets through basic knowledge in data analytics, interoperability, and business modeling. D4Ag also wants to promote cooperation between startups and platform operators to fully exploit the digital world’s opportunities. In addition, it offers digital coaching services for startups, offering agricultural services to African smallholder farmers.

This digital support will boost sector productivity and entice more youths to remain on their farms. Germany and IBM’s support to increase African farmer productivity will benefit Africa by reducing the outflow of valuable foreign reserves, increasing jobs, and gaining import substitution benefits.[x]

FarmMate in Africa

FarmMate is a digital application launched by New Holland Agriculture to provide valuable tools and agronomic advice to support farmers in Asia, the Middle East, and Africa in their daily work. The app offers detailed information on New Holland equipment and benefits to farmers. It also provides insights on farming practices, news, and dedicated services that will improve the overall after-sales experience of farmers.[xi]

The main menu offers four options, i.e., Agronomy Tips, Products, Distributors, and News. The app is customized so that the news, promotions, products, and agronomic information will be relevant to the users in their markets. It also provides insights on successfully growing the most widespread crops in the user’s area. Furthermore, it guides farmers in all the cultivation stages of the most common crops, with advice and suggestions from experts.

FarmMate also provides farmers with valuable tools such as a currency converter, promotions on spare parts and available services, and weather forecasts.[xii] In addition, as per New Holland Agriculture’s website, the Distributors function enables farmers to find and contact the nearest authorized reseller or service.[xiii]

Haller Farmers App: Supporting Africa’s Farmers to Increase Productivity

The Haller Foundation, a UK-based charity and Kenyan NGO, developed the Haller Farmers App to help farmers in Africa deal with poor soil conditions caused by unsustainable farming practices and climate change. Other problems addressed include the growing lack of arable land, a lack of agricultural knowledge, and low education levels.

The Haller app leverages mobile connectivity in Africa to promote viable farming techniques to maximize food production and build self-sustaining communities. It has equipped users in almost 50 countries worldwide with affordable, organic, and environmentally friendly agricultural practices.

Besides Haller’s farming techniques, app users learn about youth farming, human and animal conflict management, and conservation. In addition, the app connects like-minded farmers through a global messaging platform that enables them to share knowledge and the Haller team to provide support.[xiv]

AGRI-TECH IN WEST AFRICA

There are several agri-tech platforms in West Africa.

Agrix Tech in Cameroon

Agrix Tech was founded in 2018 to deal with crop pests and diseases that hamper agricultural productivity. Farmers can use the Agrix Tech app to access the technical knowledge to develop a better crop disease management strategy. In addition, the app has the benefit it uses text and voice recognition technology in several local languages to reach farmers with low literacy levels. It also helps farmers through the agricultural production cycle utilizing advice and task reminders.[xv]

AgroCenta in Ghana

AgroCenta connects all stakeholders in the staple food value chain on one platform for effective trading. Smallholder farmers in Ghana also obtain market information, storage and delivery solutions, and financial services from the platform.

It uses two integrated digital platforms, i.e., CropChain and LendIt, to address challenges to smallholder farmers requiring access to markets and financial services. Farmers advertise their products on the platform, while large buyers of selected cereals use it to purchase or enter long-term purchase contracts with AgroCenta. Smallholder farmers can use LendIt to access financial services, such as crop insurance, microloans, mobile payments, and pensions from its financial institution partners.[xvi]

Agripool in Ghana

In Ghana, crowd-farming firm Agripool links farmers to investors. Rural farmers lack skills and modern farming methods, leading to low yields and lower returns. In addition, it is expensive to access the right kind of land for farming activities, as is purchasing or renting essential farming equipment like tractors, plows, and irrigation sets.

The Agripool platform drives investment in firms and empowers rural farmers by providing training and irrigation services. It allows individuals to browse through available farms and select those they wish to fund.

Online users invest roughly US$62 per unit – each unit measures 40m2 with after-harvest returns of about US$11 per unit. One more farmer is employed for every 300 units purchased, while investors get to choose which crop to grow, and Agripool picks the best seeds to plant.[xvii]

DigiExt in Ghana

DigiExt uses digital technology to empower farm cooperatives to support farmers throughout the agriculture value chain.

It launched in 2017 to support farm cooperatives to grow and sell their produce in the market to processing companies and export agencies utilizing technology-based platforms. Examples of these farm cooperatives and organizations include the African Fertilizer and Agribusiness Partnership (AFAP) and the Peasant Farmers Association.

In addition to supporting growth and sales, DigiExt enables farmers to access credit and gain access to low-cost and convenient ICT-enabled agricultural extension services. DigiExt achieves the latter by gathering data using satellites and drones, gaining weather information, and using soil sensors to distribute production information to smallholder farmers cost-efficiently. DigiExt offers rental services for expensive merchandise like tractors and drones only used periodically.

DigiExt also provides access to a digital marketplace, using match-making algorithms to link farmers with appropriate export and food processing companies.

Processing companies and export agencies register on the platform and provide lists of required crops. The farm cooperatives then utilize DigiExt’s farm management and digital tools to offer products to these companies. As many of the risks are managed by the technology tools and extension services provided by DigiExt, the banks and insurance companies are willing to give credit to the farmers and insure them against risks like weather, pests, and diseases.

DigiExt currently has operations in West and East Africa, where it supports more than 200,000 farmers on approximately 810,000 hectares. It intends to expand into North and Southern Africa.

DigiExt receives fees from farm groups paying for access to its value proposition. They also generate revenue from origination and interest fees from the credit facilities. In addition, banks and insurance companies pay a fee for access to DigiExt’s digital tools for risk mitigation.[xviii]

BioSave in Ivory Coast

In Ivory Coast, farmers face several challenges, such as not knowing how to use chemical products, which are also expensive. BioSave is a mobile phone app that teaches farmers how to transform organic waste into natural fertilizer and insecticides, helping farmers become more independent. After sorting the organic waste available in plantations (plant leaves, cocoa pods, dry or fresh herbs, animal excrement, etc.), the farmers use the BioSave app to select a type of organic fertilizer that is easy to make themselves, using the available waste. However, the lack of mobile phones amongst the farmers remains a challenge.[xix]

myAgro: Technology Application in Mali and Senegal

myAgro operates in Mali and Senegal and was founded in 2011.

Seeds and fertilizer, two of the highest costs in a smallholder farmer’s life, are sold differently than any other product as they are only sold in bulk. myAgro’s founder wanted to make buying seeds more like buying other commodities such as sugar and create a system that provides credit to farmers.[xx]

myAgro has its headquarters in Bamako, Mali, and an office in Senegal. In just five years, the idea of using mobile technology as a savings platform has evolved from a 240-farmer trial to a multi-country program serving over 30,000 farmers. myAgro aims to reach 1 million smallholder farmers and increase their income by US$1.50 per day by 2025.[xxi]

The myAgro system works as follows:

- It is a mobile lay-buy system allowing farmers to acquire inputs

- It operates via scratch-it cards that represent value

- The scratch-it cards are available at local convenience stores, giving smallholder farmers relatively easy access

- The farmers’ unique mobile numbers act as their account number

- The scratch-it codes are texted to a number to “deposit” their money

- To make a purchase and have it delivered, farmers must text an order command

myAgro believes its model will support structural shifts in how governments and multilateral organizations fund the agricultural sector and how the financial sector provides services to smallholder farmers.[xxii]

Agrorite in Nigeria

Agrorite is a digital agricultural commodity trading and logistics platform. Its aims at helping Nigerian smallholder farmers to sell their farming products to local and international buyers at fair and competitive prices, which is a significant challenge for African smallholder farmers. Agrorite has aligned itself with the SDGs, with Goal 2, Zero Hunger, as its focus. Agrorite helps farmers with crop yields, financial inclusion, trading, and logistics. To increase transparency and the integrity of the system, Agrorite will be incorporating blockchain on its platform sometime in the future.[xxiii]

Alosfarm in Nigeria

Alosfarm is a combination of tools, services, and capabilities for farmers, agribusinesses, and enterprises. It is also an all-in-one farm management platform to optimize pre- and post-harvest farming activities. It also collects and aggregates datasets, which can be fed into any destination wanted.

In streamlining pre-harvest farm activities, Alosfarm provides action points about the farming techniques, processes, field support, and updated information to enhance farming knowledge, thereby providing real-time information to the farmers.

In automating post-harvest farm activities, Alosfarm connects agribusinesses, buyers, delivery logistics, and farmers in a seamless interface, minimizing human resource involvement in the procurement processes of the agricultural value chain. It automates the buy and sell of farm produce, streamlining interactions into a process flow, driving post-harvest losses down to zero, and boosting efficiency and profitability.

Alosfarm provides data transmission infrastructure for organizations working with local farmers and real-time agri data and content for farmers in Africa. This collected data can be fed into any desired destination via mobile, SMS, or in one unified web interface.

Its Enterprise Features include automating purchasing for enterprises with complex purchasing functions. Its Partners Integration function enables key businesses like logistics to integrate their procurement process. [xxiv]

ColdHubs in Nigeria

Although strictly speaking not an agri-tech app based on digital technology, ColdHubs provides an essential service.

Many smallholder farmers producing fresh produce in Africa do not have electricity or can afford cooling technology. This leads to increased post-harvest losses. Nnaemeka Ikegwuonu established ColdHubs in 2015 to help farmers reduce post-harvest losses.

ColdHubs consists of a solar-powered walk-in cold room for smallholder farmers in farm clusters and outdoor markets to continuously store and preserve fresh produce, allowing farmers to extend the shelf life of fresh produce from two to more than 21 days. The solar panels are linked to a battery storage system, allowing cold rooms to operate off the grid all day.

ColdHubs is available in 22 states in Nigeria. It intends to expand its technology and service to East Africa, Southern Africa, and some western and Francophone-African countries.[xxv]

Complete Farmer in Nigeria

Complete Farmer believes the lack of funding for smallholder farmers and other stakeholders in the agriculture sector is a major driving force for dependence on food imports. Importing food that can be grown on the continent limits economic growth in Africa.

Complete Farmer contributes to linking potential investors with farmers in need of funding. Integrating the fintech and agri-tech sectors, platforms like Complete Farmer are becoming increasingly popular with investors.

Complete Farmer’s platform also doubles as a commodity-sourcing platform, where global commodity buyers source agriculture products directly from the farms. This is in addition to expanding access to finance for Africa’s smallholder farmers.[xxvi]

eFarmers Nigeria

eFarmers Nigeria connects farmers in Nigeria and allied businesses to numerous customers in Nigeria and abroad by offering a free classified ads service. It provides a digitalized farm-based market for advertising products and services free of charge.[xxvii]

It enables sellers to:

- Post free ads and images

- Receive live updates on market prices and services of agricultural products

- Diversify or increase their service delivery, e.g., offer special discounts

- Get listed on Top Rated Products

- Get product reviews and recommendations

- Receive calls, text messages, and emails from authenticated buyers

Buyers can:

- Buy anything by directly calling or messaging sellers and agreeing on purchase terms

- Receive updates on special deals from their favorite farmers

- Rate and review completed trades

- Share and promote products on social media

- Report sellers if unsatisfied with a product or service

EZFarming in Nigeria

EZFarming is another Nigeria-based agricultural technology startup. It benefitted from a US$150,000 seed funding from 500 Startups, a USA-based accelerator. The EZFarming platform enables farmers to access funding such as micro-loans and easy access to produce buyers worldwide. Participants in the accelerator must exchange a 6% equity stake in their business for funding, mentorship, and hands-on training. In addition, participants also must pay a fee of US$37,500 for participating in the 500 Seed Programme. Since its inception in 2018, EZFarming has worked with more than 800 microlenders to invest over US$800,000 in more than 120 verified and trusted farmers who are scaling fast to become commercial farmers.[xxviii] [xxix]

FarmCrowdy in Nigeria

Nigeria’s first digital agricultural platform, FarmCrowdy, helps smallholder farmers improve their production. These smallholder farmers struggle to obtain funds to improve farming methods and boost their yields. FarmCrowdy addresses this challenge by connecting farmers directly with local investors, thereby generating healthy returns for investors and farmers alike.

The FarmCrowdy platform encourages Nigerians to participate in agriculture while going about their regular routine. Investors use the platform to select the farms they want to invest, and then pay FarmCrowdy to make the arrangements. They can invest in cassava, maize, poultry, and tomato farms. After receiving funds, FarmCrowdy hires the farmers, leases the required land, and sources seed or buys animals. At the end of the investment cycle, investors can either cash out or reinvest on the platform.

FarmCrowdy advertises a 20% return bi-annually. Farmers get 40% of the profit, investors get 40%, and Farmcrowdy receives 20%. Farmcrowdy plans to expand into West and East Africa.[xxx]

To help smallholder farmers with their financing challenges, Farmcrowdy reportedly raised over US$15 million for 25,000 farmers in four years while providing several other benefits.

FarmCrowdy has the potential to make farming a lucrative option by providing land, capital, and labor. Its model also can entice the youth to take agriculture more seriously. The envisaged returns are significant as well. Africa needs this kind of model to boost the industrialization of its agricultural sector. FarmCrowdy’s model has served as the basis for various other initiatives.

Farmgate Africa in Nigeria

Farmgate Africa (FGA), a subsidiary of the Farmcrowdy Group, recently launched as a technology-driven trading marketplace for agriculture commodities. It bridges the gap between rural farmers and processors, allowing buyers to purchase commodities directly from farming clusters using technology.

The FGA platform reportedly builds relationships between farmers and processors, aggregating commodities bearing in mind the unique specifications of buyers. Nigerians can fund the process of buying and selling what farmers have already harvested, allowing farmers to sell their produce to major buyers through FGA’s portal.

Its business model eliminates several layers of intermediaries, thereby optimizing market access to African farmers and improving their income by at least 30%.[xxxi]

Farmer in Suite in Nigeria

Farmer in Suite is similar to FarmCrowdy. Its founders believe Nigeria’s agriculture system is constrained by subsistence farming, poor access to agribusiness innovation systems, very few extension workers, and lack of access to finance. Rural farmers need access to funding, farm inputs, and farm extension services to increase domestic food production. The vision of Farmer in Suite is, therefore, to provide investment solutions to help absentee farmers make a return on their investment.[xxxii]

The “Farmer in Suit” platform gives farm sponsors an opportunity to “own” farms and generate a profit while going about their other businesses. They can monitor progress on their farms using the web from anywhere in the world. The platform’s main points are as follows: [xxxiii]

- The investor becomes a farmer, monitors the farm’s progress, and generates a guaranteed profit on the farm investments by sponsoring rural farmers

- This process creates local employment and empowers the rural farmers to increase productivity and their livelihood, increasing Nigeria’s domestic food production, and fighting global food security challenges

Typical farms available for investing include maize, poultry, and soybeans.

Joining Farmer in Suite has the following impact:[xxxiv]

- Profitable investment: Farm sponsors enjoy profit sharing between 8 – 25% of investment

- Empowering Farmers: Their farmers can keep their jobs and optimize their lands to increase productivity and improve their livelihood

- Food Security: Investors support Nigeria’s domestic food production and food security

- Social Impact: Farmer in Suite provides school kits for poor children in rural areas for every block of farms sponsored

Growcropsonline.com[xxxv]

Growcropsonline allows busy people to farm. They believe anyone can own and run a farm online using mobile phones or laptops. The investor simply chooses a crop, the location, and the land size and pays for it online. The investor receives a certificate as evidence of the details of the investment booking.

During planting, weeding, herbicide spraying, and harvesting, investors are prompted to pay online for these services. They are also entitled to visit their farm parcel at any time through a Pre-book Appointments System. During the visit, the farm manager is available for inquiries. The farming process is insured, so investors do not lose money.

The investor can at any time request a valuation of the farm and can sell their interest in the farm.

After harvest, the investor will receive the produce or send it for processing and selling.

reQuid in Nigeria

reQuid aggregates profiled investment opportunities in Nigeria. They partnered with Redwoods Capital Limited to profile available investments, assess the risk, and verify the insurance coverage. They make this information available to prospective investors. Investment products include cucumbers, fish, lettuce, poultry, and soybeans, to name but a few.

The investments are available in smaller units to be more affordable for low-income earners. Investors can also sell their investments before the maturity date. While it costs nothing to invest, there is a 3% fee for liquidating investments before maturity.

The duration of investments varies but is generally between three to twelve months.

There is no limit on the number of times one can invest or liquidate one’s investments. Returns vary but can be significant.[xxxvi]

ThriveAgric in Nigeria

ThriveAgric links smallholder farmers to funding opportunities, using data to increase farmer yields and connect them to lucrative markets. They allow investors to fund these farmers and get predictable returns upon harvest. They worked with over 11,000 farmers in 12 states in Nigeria. Amongst others, their farmers raised over 750,000 birds. ThriveAgric’s goal is to reach out to 1 million farmers in Africa over the next few years.[xxxvii]

ThriveAgric believes it can solve Africa’s food shortages, develop farming communities, and use technology to increase yields and productivity. Their extension workers use an app that provides up-to-date information, and their farmers get automated messages. As a result, their farmers get as much as twice what their average yields would have been.

This process works as follows:

- The investor creates an account using email

- The investor chooses a farm(s) and the quantity they want and pay the subscription fee online

- The investors get multimedia updates from events on the farm that assists them in offering support on the production process

- Upon successful harvest, the produce is sold, and the revenues are distributed to the subscribers.

Note on agri-tech platforms in Nigeria

According to an article by Michael Ajifowoke in Techcabal on 22 February 2022, Covid has played havoc with a number of these agri-tech platforms. Those under duress include Agrorite, Farmcrowdy Farmsponsor, reQuid, and Thrive Agric. New SEC rules in Nigeria have also led to most of the biggest platforms in the space leaving crowdfunding. Under the new regulations adopted in January 2021, crowdfunding can only be raised through an online portal operated by SEC-registered intermediaries, which must have a minimum paid-up capital of ₦100 million (US$240,000) and a current Fidelity Insurance Bond valued at 20% of the paid-up capital.[xxxviii]

AGRI-TECH IN EAST AFRICA

Farm Capital Africa in Kenya

Farm Capital Africa (FCA) was created in 2014 to support the millions of small-scale farmers in Kenya who were locked out of the country’s formal economy. The goal of FCA is to generate wealth through investing in profitable business ventures in the underfunded agricultural sector. FCA uses the internet to raise funds and mobile money to disburse to agripreneurs — primarily youths and women. They connect these farmers with investment groups that can help them access funds to scale their agricultural ventures. FCA, therefore, participates in a profit- and loss-sharing arrangement between the agripreneurs and the investor. The company also provides input financing to small-scale farmers by partnering with local agrovets (places where farmers can buy agricultural and veterinary products). On joining the program, they pick inputs from the agrovet on credit and pay upon harvest.[xxxix]This is effectively the same model used by cooperatives in other parts of Africa, such as in South Africa.

FarmDrive in Kenya

FarmDrive addresses the lack of access to finance for smallholder farmers in the formal financial ecosystem. Financial institutions are unwilling to provide farmers with the financing to boost their productivity. While these smallholder farmers need capital to help grow their farms beyond the subsistence level, banks only lend to larger commercial farmers with credit histories and collateral.

Banks can use FarmDrive’s innovative alternative credit-scoring model to assess the creditworthiness of farmers and allow more to access financing while still protecting banks against defaults. Farmers can use FarmDrive to apply, receive, and repay their loans using their mobile phones. Its role is to bring together all the available information on smallholder farmers.[xl]

FarmDrive has positioned itself as a data analytics firm targeting financial institutions keen on lending to smallholder farmers. It recently also partnered with a large telco in Kenya – instantaneously expanding the number of smallholder farmers in its network from 3,000 to more than 100,000.[xli]

FarmSmart in Kenya

FarmSmart is an application launched in Kenya at the end of October 2019. The mobile application will send essential, sustainable, and climate-smart farming knowledge to Kenyan farmers. It also provides tailored recommendations for farmers based on location, soil type, season, and irrigation access. FarmSmart aims to empower anyone to be an agri-entrepreneur.[xlii]

Hello Tractor in Kenya (also in Nigeria)

Access to agricultural equipment is problematic as it is expensive. The Hello Tractor platform enables farmers to request affordable equipment services while providing enhanced security to tractor owners through remote asset tracking and virtual monitoring. This allows tractor owners and manufacturers to expand their markets, reaching previously inaccessible customers.

The solution links tractor owners, smallholder farmers, banks, and dealers. While most smallholder farmers struggle to purchase a tractor, they can pay for tractor services.

It is an Internet-of-Things (IoT) solution that supports improved efficiencies, profitability, and transparency in the tractor contracting market. Their solution is a tractor monitoring device installed on the tractor, connecting it to the Hello Tractor cloud. Once connected, the device transmits relevant data across its ecosystem. The device is fitted with an international SIM card for higher connectivity but can store activity data locally if no connection exists.[xliii]

The Tractor Owner app incorporates several tools to improve the business and operations of tractor owners. Accessing new customers, increasing efficiencies, and enhancing oversight lead to higher revenues, lower costs, and increased trust and transparency.

M-Shamba in Kenya[xliv]

M-Shamba is a solution for the smallholder farmer using the power of mobile telephony. M-Shamba has embraced the latest emerging technological tools like AI, Machine Learning, the IoT, and Blockchain to create sustainable solutions for the farmer. Their solutions entail the following:

- Interactive Voice Service: an easy and effective way to disseminate information to the smallholder farmers in rural areas

- Virtual Call Centre: M-Shamba’s call center platform makes the use of a call center cheap and straightforward

- Interactive SMS: SMS on agronomy, weather forecasts, climate change adaptations, enterprise development, etc.

- Customized Mobile Applications: M-Shamba can customize apps on GIS, surveys, monitoring, evaluation, trade, learning, and financial inclusion for their target audience

M-Shamba has also launched the following programs:

- Digital Literacy: Imparting digital skills to the rural population

- Market Access: Links farmers to markets by identifying markets and supporting farmers to meet the quality demands

- Farming as a Business: Farmers receive resources and tools to enable them to create enterprises on their farms instead of farming as a lifestyle

M-Shamba’s homepage indicates the following performance levels:

- Smallholder farmers supported: 68,546

- Land covered: ±162 ha

- Commodities traded: US$12 million

- Number of farmer cooperatives collaborated: 90

Pula: Digital Insurance for Smallholder Farmers

Pula was founded in 2015 in Nairobi as a micro-insurer for smallholder farmers to build and deliver scalable insurance solutions for Africa’s 700 million smallholder farmers. It specializes in digital and agricultural insurance to help mitigate the risk of these smallholder farmers.

Farmers can improve their farming practices, increase their income, and deal with climate risk and changes by accessing a range of digital products and agricultural insurance through Pula. Its business model is based on creating an affordable insurance solution for smallholder farmers as an alternative to the costly traditional insurance providers.

Pula leverages machine learning, crop cuts experiments, and data points related to weather patterns and farmers’ losses to customize tailor-made products for specific farmers. Their model considers various risks such as drought, pests, diseases, and flooding.

Pula has reportedly already assisted over 4.3 million smallholder farmers in Africa. It was named the “InsurTech of the Year” at the African Insurance Awards 2020. Pula recently secured US$6 million in a Series A funding round to scale up its operations in 13 African markets and expand into Asia.[xlv]

Sarafu: Cryptocurrencies for Kenyan Farmers

Sarafu is a cryptocurrency that works like vouchers that enable users, like farmers, to sell products and buy input materials such as seeds and fertilizer. Will Ruddick, an American economist, developed the cryptocurrency through his Kenyan non-profit, Grassroots Economics. It works like a “voucher” that can be exchanged for goods or services of other users of the currency. People with a Kenyan mobile phone line can enroll. Users are given 50 Sarafu for free. After that, they earn coins by selling a product or service to another user.

Sarafu is a community inclusion currency, or CIC, allowing people to give or take credit without depositing money in a bank. The Sarafu coins will be based on agriculture production across Kenya.

Community-focused cryptocurrencies reportedly have the potential to expand into the rest of Africa. They give communities the ability to monetize resources in a way that they cannot do with cash.[xlvi]

Using IoT at Twiga in Kenya to Boost Food Production

Liquid Telecom recently partnered with Twiga Foods to increase agricultural productivity through precision farming. Kenya’s rapidly expanding Internet of Things (IoT) network will enable this initiative. The new system will initially be employed at Twiga’s Takuwa farm.

The system applies four different types of agricultural sensors to capture data in the field and convert it to digital form. These sensors provide critical information to the Twiga agronomy team:

- Farmers can use the most effective farming methods for irrigation and the application of pesticides utilizing real-time data obtained from a smart weather station

- Water quality sensors provide specific metrics to optimize fertilizer application and data on temperature, humidity, rainfall, and wind speed

- Soil probes measure moisture levels and temperature to provide precise information on soil quality and irrigation needs at the roots of specific crops

- Borehole water meters

Applications of IoT have the potential to transform agricultural productivity, leading to greater food security and improved farmer incomes in Kenya. Numerous processes have already been automated across the farm production cycle.[xlvii] [xlviii]

Kilimo Fresh Agriculture Digital Platform in Tanzania

Kilimo Fresh is a B2B produce distribution platform in Tanzania that connects smallholder farmers and produce buyers to a fair and reliable market. The platform enables buyers to access better-quality and fresh produce directly from farms at affordable prices and deliver it directly to their locations. It provides farmers with stable pricing and direct access to the market for their crops, also eliminating food waste.

Challenges such as dealing with intermediaries, low margins, lack of market information and demand visibility, and food waste led the developers to form Kilimo Fresh in 2018 to solve these problems for other farmers in Tanzania.

The company currently operates in two regions in Tanzania, i.e., Dar es Salaam and Dodoma, supplying their daily fruits, vegetables, and grains. They intend to expand to Zanzibar and Arusha, and other East African countries, especially Rwanda.[xlix]

AGRI-TECH IN SOUTHERN AFRICA

Aerobotic in South Africa

Aerobotic is a data analytics company founded in 2014 and optimizes crop performance for farmers globally using aerial imagery and machine learning algorithms. Aeroview is the cloud-based pest and disease management application of Aerobotic. Farmers use Aeroview to inspect threats and view farm analytics data on a machine-learning-enabled platform. Their service is available in 18 countries across Africa, Asia, and Europe.[l]

Livestock Wealth in South Africa

Livestock Wealth connects online investors with investment opportunities in the agriculture sector. First, investors buy the young asset, either livestock or plant-based. Next, the asset grows in the farmer’s care, and then the farmer buys back the asset once it has fully grown at harvest; the investor benefits from the sale.

There are various classes of assets available. They include free-range oxen, pregnant cows, macadamia nuts, and connected garden products. Since its start, it has attracted more than 3,600 investors, who have invested more than R100 million. More than R30 million of profits have been paid out to investors. More than 70 farmers have been impacted.[li]

TonnUp in South Africa

TonnUp recently launched an online trading platform to support farmers in marketing and selling their agricultural produce to disrupt the South African commodities market. The developers aim to help farmers get a fair price for their produce by empowering them to “dictate the pricing, marketing, and distribution of their products.” The company directly connects buyers and producers to ensure that all stakeholders get a fair deal.

The founders of TonnUp believe the platform helps farmers get maximum value for their products, while buyers can make more informed purchasing decisions. The process creates a transparent and efficient market. The farmers can list their products on the platform, while buyers (millers and processors) can bid on the products and preferred delivery locations. The platform has reduced the admin and paperwork involved in the process. It facilitates the cash-flow process to ensure farmers receive their payments and buyers receive their stock as quickly as possible.

The initial focus of TonnUp will be on grain, but it will eventually expand into other commodities such as oil cake, fertilizer, soya, and sorghum.

As less than 25% of the 16-million-ton market is traded in a formal market, it leaves a massive opportunity for platforms such as TonnUp. It is conceivable that the market is large enough for more platforms like TonnUp to tap into this opportunity.[lii]

AgriPredict in Zambia

A lack of timely agricultural data for farmers in Africa affects their yields. AgriPredict addresses this challenge by linking farmers with access to information to help them identify diseases and predict pest infestations and weather conditions.

While AgriPredict can alert farmers on detecting a disease or pest infestation in a specific area, farmers can photograph a suspected diseased plant and have AgriPredict provide a diagnosis, treatment options, and the location of the closest agri-dealer in the area. AgriPredict also connects farmers with markets where they can receive a fair price for their products. The app is available on smartphones.[liii]

eMsika in Zambia

In Zambia, the ratio of agriculture suppliers to farmers is 1 to 7,000, which forces farmers and agri-dealers to travel long distances, losing valuable time and money.

eMsika helps farmers find, buy, and receive agricultural inputs in a fast, reliable, and convenient way and creates access to markets for their produce. It is an e-commerce store for farmers, listing over 300 products in 10 different categories of agricultural input. Their clients can source inputs and contact suppliers in their local language. They also serve areas in the DRC, Mozambique, Namibia, and Zimbabwe and plan to expand across the continent. They have six suppliers in several agricultural sectors, such as livestock, poultry, and horticulture, in addition to a database of 500 farmers and 200,000 affiliates.

Farmers can also sell their produce at fair prices. eMsika has introduced a call center for farmers to access knowledge on products before purchasing them. In addition, it has introduced m-commerce features that supplement the use of its website for all customers in areas of no or limited internet.[liv]

Musika in Zambia

Musika leverages mobile technology to offer two services. Musika Solutions is an app-based agriculture marketplace for farmers to buy inputs at a discount from its partners. Musika Express is a commodity and agro-alerts platform that aggregates agricultural data to provide users with daily price updates from the markets, disease alerts, and weather updates. Farmers can also carry out trend analysis per commodity for up to five years. Musika currently reaches 10,000 farmers.

The revenue models of the two services are simple. Suppliers can list their products on Musika Solutions for a monthly fee. Musika also gets a referral fee for each product sold on promotion. Musika Express is an ad and subscription-based platform, and suppliers pay to place ad campaigns on the site. It is currently free for farmers, although they will pay a monthly fee in the long term.[lv]

EcoFarmer in Zimbabwe

Farmers in Zimbabwe buy inputs, sell their produce, and maintain insurance policies via mobile phones. EcoFarmer, a mobile platform developed by Econet Wireless, provides micro-insurance for farmers to insure their inputs and crops against drought or excessive rain via SMS and voice-based messages on their mobile phones. The services cover a broad range such as weather information, using fertilizer, treating crops against pests, buying inputs, selling their produce, and accessing a wide range of applications such as funeral policies for their families, all via mobile phones. These digital services help farmers increase their productivity, profits, and resilience to climate change.

Econet recently partnered with the Zimbabwe Farmers Union (ZFU) to offer the ZFU EcoFarmer Combo, an information and financial service, to more than 1 million ZFU members. The members receive agriculture tips based on their farming area and weather-based indexed crop insurance.

BLOCKCHAIN IN AGRICULTURE IN AFRICA

According to a Ventures Africa article by Adekunle Agbetiloye,[lvi] Africa’s technological-agricultural synergy is not yet at its peak. He believes that more technology is required to transform Africa’s agriculture sector. One such a technology is blockchain technology. In addition to its role in cryptocurrency, blockchain is applied in various sectors such as transportation, lottery businesses, politics, and agriculture. The content below is derived from this article.

Blockchain technology was used to transform Zimbabwe’s beef export market. The country experienced an outbreak of a tick-borne disease in 2018 that decimated its cattle herds. At the time, Zimbabwe’s cattle sub-sector contributed US$50 million annually to the wealth of the country. This contribution and Zimbabwe’s credibility as an international beef exporter suffered significantly from the outbreak. Zimbabwe lost revenues as it could not sell beef to its lucrative markets in Europe and the Middle East due to a lack of a traceability system. In 2021, a blockchain-based cattle traceability system brought end-to-end visibility to the cattle supply chain in Zimbabwe. Tracking the medical history of cattle on a tamper-proof blockchain ledger helped renew trust in Zimbabwean cattle farming and re-established Zimbabwe’s beef exportation credibility.[lvii]

Other uses of blockchain in agriculture include the following:

- In the agricultural supply chain: Agriculture products are tracked transparently from production to delivery. Consumers can source information regarding the origin of food and data on harvesting, processing, and production by scanning a QR code.

- In agricultural trade: Transaction processes are simplified, and common ground for small-scale farmers is created. Blockchain enables transparent peer-to-peer transactions in the sector without an intermediary, which reduces the cost of agriculture products.

- In Nigeria, Agrichainx is a blockchain agricultural platform that helps farmers, retailers, distributors, and manufacturers to connect seamlessly and interact with each other.

- Smart contracts are blockchain-based in which the contractual clauses are executed without human intervention. In agriculture, they are used for finance and insurance, green bonds, and land registration and verification.

- Smart contracts also provide better insurance programs for farmers as they use sensors to make the process transparent and minimize the risk of false claims.[lviii]

CONCLUSION

The examples referred above are not an exhaustive list of the available agri-tech apps available within the agriculture sector in Africa.

The number of African countries embarking on agri-tech strategies is growing, including Ghana, Kenya, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Tunisia, Uganda, Zambia, and Zimbabwe. These countries achieved their successes by integrating technology in the value chains. Technological innovations in agriculture are crucial for developing productivity, optimizing yields, and reducing waste.

Africa’s agri-tech industry remains underdeveloped with colossal potential. By focusing on the upstream and downstream players, value can be unlocked by leveraging the utilities of modern technology. The players are using the spectrum of technology to solve the pain points of the various players.

The applications and platforms listed above support the increase in agricultural productivity and address the challenges of food insecurity in Africa. Significantly improving productivity can assist Africa in saving on its annual net food import bill of US$41 billion. Import substitution can also enhance the balance of payments and create more jobs in the process.

Some experts view digitalization as a game-changer, modernizing and transforming the economics of Africa’s agriculture while attracting the youth to the agriculture sector and enabling farmers to optimize production. Agri-tech also supports farmers to make their crops more resilient to climate change. Using digital solutions, farmers can reportedly increase yields ranging from 23% to 73%, with revenue increases of up to 37% percent. Furthermore, the sector can use agri-tech to increase farmer productivity and market access, in addition to providing the location of the most appropriate markets on any given day.

Utilizing mobile technology in the agriculture sector is a rapidly growing phenomenon and is only constrained by the imagination of the developers. However, it does seem that applications linking investors to farmers (mostly tapping into crowdfunding) and opening opportunities in the market in a seamless value chain are becoming increasingly popular.

Some, like Agrorite, focus on market growth to help the farmers get more profitable opportunities. All of them have the added benefit of addressing the challenge of food security. In Nigeria, FarmCrowdy has become a benchmark for other applications to either copy or use as a point of departure for additional developments. It seems the Farmcrowdy model that links stakeholders in the sector and creates access to markets has been emulated in several countries throughout Africa.

Increasing cheap smartphones in Africa, improving access to broadband internet, reducing the cost of data, and improving education levels will increase the impact of technology on Africa’s agriculture sector. Hopefully, these improvements will increase food security and encourage the youth to embrace agriculture as a career option.

We see initiatives to use smart agriculture and modern fertilizers to increase food production yields. However, food security will remain a challenge for some time, given the population growth, the high urbanization rates, and the conversion of agricultural land into suburbs. Smallholder farmers that produce significant quantities of food in Africa are the target of many of these initiatives. However, more needs to be done to ensure these critical stakeholders’ productivity and future viability. The average age of a smallholder farmer in Africa is over 50 years (can be as high as 63). This demographic does not bode well for African food security unless something is done to alter the pattern.

Agri-tech, including technologies such as drought management, crop protection, and yield enhancement, can contribute substantially to employment (including jobs for youth), wealth creation, and improved health and nutrition in Africa. The rapid pace of growth in drones, automated tractors, artificial intelligence, robotics, and blockchains is transforming agriculture. Smart farming and technological innovations boost productivity, but more education, connectivity, and funding are required. Connectivity in the rural communities also needs to be enhanced by providing additional spectrum.

Utilizing technology such as IoT and automation to improve agricultural productivity is essential to improving food security in Africa. Boosting yields through optimized production techniques is a well-understood path to this goal. Yet Africa’s food import bills are a shockingly high and largely unnecessary use of scarce foreign reserves, given the potential of the continent to produce its food. Low yields are a severe constraint to achieving food security. Automation is not the only technology that will boost food security. Farmers should also reach out and embrace solutions such as better-quality seed and modern irrigation methods.

Figure 3 below provides a view of the primary and secondary value chain activities in which the various agri-tech apps play a role. From this view, agri-tech’s influence has become quite pervasive.

Figure 3: Presence of Agri-Tech in the Agriculture Value Chain

The author, Johan Burger, is the Business Development Manager of the College for Business and Economics at the UAE University. He also serves as a research fellow of the NTU-SBF Centre for African Studies at Nanyang Technological University in Singapore and the Institute for Futures Research at the University of Stellenbosch Business School in South Africa. Johan can be reached at johan.burger@uaeu.ac.ae.

This report is an updated version of an article by the author published in AfricaBusiness.com on 15 April 2019. Some of the entities may no longer exist.

Burger, J.H. 2019. Tapping into Digital technology Platforms to increase Agricultural Productivity in Africa. AfricaBusiness.com. 15 April 2019. Available at https://africabusiness.com/2019/04/15/agriculture-productivity-in-africa/.

Other Sources:

- Agbetiloye, A. 2022. How blockchain can help transform agriculture in Africa. Ventures Africa. 11 February 2022. Available at https://venturesafrica.com/how-blockchain-can-help-transform-agriculture-in-africa/. Accessed 15 February 2022.

- Agbetiloye, A. 2021. 11 Mission-driven agritech startups in Africa you should know about. Ventures Africa. 3 December 2021. Available at https://venturesafrica.com/here-are-11-mission-driven-agritech-startups-in-africa-you-should-know-about/. Accessed 15 February 2022.

- Ajifowoke, M. 2022. From celebrated platforms to fraud claims: Why Nigeria’s agric crowdfunding fintechs came crashing down. Techcabal. 22 February 2022. Available at https://techcabal.com/2022/02/22/nigeria-agric-crowdfunding-crash/?utm_source=Newsletter&utm_medium=TC_daily&utm_campaign=rip_what_you_sow&utm_term=2022-02-23. Accessed 24 February 2022.

- Anon. 2020. IBM supports African agricultural startups. IT-Online. 8 December 2020. Available at https://it-online.co.za/2020/12/08/ibm-supports-african-agricultural-start-ups/. Accessed 15 February 2022.

- Anon. 2019. Nigerian Agri-tech startup, EZ Farming clinches $150,000 seed funding. NIPC. 27 August 2019. Available at https://nipc.gov.ng/2019/08/27/nigerian-agric-tech-startup-ez-farming-clinches-150000-seed-funding/?mc_cid=69fb77359d&mc_eid=5996ec09d0. Accessed 15 February 2022.

- Anon. 2019. Growing African agriculture one byte at a time. Africa.com. 19 July 2019. Available at https://www.africa.com/growing-african-agriculture-one-byte-at-a-time/?utm_source=Africa.com&utm_campaign=c6128c6918-EMAIL_CAMPAIGN_2019_05_27_09_40_COPY_01&utm_medium=email&utm_term=0_12683c81a6-c6128c6918-29147709. Accessed 15 February 2022.

- Chetty, I. 2021. SA agritech launches innovative commodities trading platform. Ventureburn. 9 April 2021. Available at https://ventureburn.com/2021/04/sa-agritech-launches-innovative-commodities-trading-platform/. Accessed 15 February 2022.

- Chetty, I. 2021. Kenyan insurtech startup secures $6 million. Ventureburn. 26 January 2021. Available at https://ventureburn.com/2021/01/kenyan-insurtech-startup-secures-6-million/. Accessed 15 February 2022.

- Coldhubs. nd. The solution: Walk-in, solar-powered cold stations for 24/7 storage and preservation. Coldhubs. nd. Available at https://www.coldhubs.com. Accessed 15 February 2022

- CTA and Dalberg Advisors. 2019. The Digitalisation of African Agriculture Report, 2018-2019. June 2019. Available at https://hdl.handle.net/10568/101498. Accessed 15 February 2022.

- Delport, J. 2021. What is the Haller App, and how is it assisting farmers in Africa. IT News Africa. 29 January 2021. Available at https://www.itnewsafrica.com/2021/01/what-is-the-haller-app-and-how-is-it-assisting-farmers-in-africa/. Accessed 15 February 2022.

- DigiExt. nd. Data-driven farming for smallholders. DigiExt. nd. Available at https://www.digiext.com. Accessed 15 February 2022.

- EABW Editor. 2019. Technology uptake going up in Uganda’s Agriculture Sector. EABW Digital. 19 July 2019. Available at https://www.busiweek.com/technology-uptake-going-up-in-ugandas-agriculture-sector/. Accessed 15 February 2022.

- Elmendorp, R. 2021. Cryptocurrency booming among Kenyan farmers. Voice of America. 26 July 2021. Available at https://www.voanews.com/africa/cryptocurrency-booming-among-kenyan-farmers. Accessed 15 February 2022.

- EZFarming. nd. About our agricultural investment company. EZFarming. nd. Available at https://ez-farming.com/about. Accessed 28 February 2022.

- FarmSmart. nd. FarmSmart: About us. FarmSmart. nd. Available at https://www.farmsmart.co/about-us. Accessed 28 February 2022.

- Jackson, T. 2021. Data-driven farming for smallholders. Disrupt Africa. 2 August 2021. Available at https://disrupt-africa.com/2021/08/02/how-ghanas-digiext-helps-farm-cooperatives-develop-and-grow/?utm_source=Africa.com&utm_campaign=11a87324dd-EMAIL_CAMPAIGN_2019_05_27_09_40_COPY_01&utm_medium=email&utm_term=0_12683c81a6-11a87324dd-29147709. Accessed 15 February 2022.

- Jackson, T. 2020. Meet Kilimo Fresh, the Tanzanian agri-tech startup that won this year’s MEST Africa Challenge. Disrupt Africa. 5 October 2020. Available at https://disrupt-africa.com/2020/10/meet-kilimo-fresh-the-tanzanian-agri-tech-startup-that-won-this-years-mest-africa-challenge/?utm_source=Africa.com&utm_campaign=d083ebe328-EMAIL_CAMPAIGN_2019_05_27_09_40_COPY_01&utm_medium=email&utm_term=0_12683c81a6-d083ebe328-29147709. Accessed 15 February 2022.

- Jackson, T. 2020. “Crowd-farming” startups address vicious cycle and eye wider impact. Disrupt Africa. 3 March 2020. Available at https://disrupt-africa.com/2020/03/crowd-farming-startups-address-vicious-cycle-and-eye-wider-impact/?utm_source=Africa.com&utm_campaign=5c9eb3e690-EMAIL_CAMPAIGN_2019_05_27_09_40_COPY_01&utm_medium=email&utm_term=0_12683c81a6-5c9eb3e690-29147709. Accessed 15 February 2022.

- Jackson, T. 2020. Ghana’s Agripool is the latest crowd-farming platform looking to make an impact. Disrupt Africa. 24 February 2020. Available at https://disrupt-africa.com/2020/02/24/ghanas-agripool-is-the-latest-crowd-farming-platform-looking-to-make-an-impact/. Accessed 24 February 2022.

- Livestock Wealth. nd. Livestock Wealth: how it works. Livestock Wealth. nd. Available at https://livestockwealth.com/how-it-works/. Accessed 28 February 2022.

- McBain, W. 2020. Agritech platforms revolutionise farming investment. African Business Magazine. 11 August 2020. Available at https://africanbusinessmagazine.com/sectors/agriculture/agritech-platforms-revolutionise-farming-investment/?mc_cid=7b7f26d2f9&mc_eid=512a079920. Accessed 15 February 2022.

- Mkhonza, T. 2020. Liquid Telecom partners with Twiga Foods to accelerate agricultural transformation in Kenya. IOL. 17 June 2020. Available at https://www.iol.co.za/business-report/companies/liquid-telecom-partners-with-twiga-foods-to-accelerate-agricultural-transformation-in-kenya-49505997. Accessed 15 February 2022.

- Monzon, L. 2020. Tech is essential in developing a flourishing agriculture sector in Africa. IT News Africa. 26 June 2020. Available at https://www.itnewsafrica.com/2020/06/tech-is-essential-in-developing-a-flourishing-agriculture-sector-in-africa/. Accessed 15 February 2022.

- Ngounou, B. 2019. Ivory Coast: BioSave, an application to promote biofertilizer production. Afrik 21. 23 October 2019. Available at https://www.afrik21.africa/en/ivory-coast-biosave-an-application-to-promote-biofertilizer-production/. Accessed 15 February 2022.

- Phakathi, M. 2020. Digitisation could transform African agriculture. IPS News Agency. 2 December 2020. Available at http://agriculture.einnews.com/article/531907500/sGUaap4KYOHWvzRj. Accessed 15 February 2022.

- reQuid. nd. reQuid – the Amazon for safe investments. reQuid. nd. Available at https://market.requid.com/about. Accessed 24 February 2022.

- Traore, C.T. 2020. Five startups that are transforming Africa’s agriculture. Malabo Montpellier Panel. 6 September 2020. Available at https://www.mamopanel.org/news/blog/2020/sep/6/five-start-ups-are-transforming-africas-agricultur/. Accessed 15 February 2022.[lix]

[i]https://www.reuters.com/article/us-africa-agriculture-tech/africa-bets-on-technology-to-lure-youth-to-farming-idUSKCN1MD1Y6?utm_source=Africa.com&utm_campaign=1db3c0cea5-EMAIL_CAMPAIGN_2018_06_18_02_08_COPY_01&utm_medium=email&utm_term=0_12683c81a6-1db3c0cea5-29147709

[ii] https://venturesafrica.com/here-are-11-mission-driven-agritech-startups-in-africa-you-should-know-about/

[iii]https://oxfordbusinessgroup.com/sites/default/files/blog/specialreports/960469/OCP_Agriculture_Africa_Report_2021.pdf)

[iv]https://oxfordbusinessgroup.com/sites/default/files/blog/specialreports/960469/OCP_Agriculture_Africa_Report_2021.pdf

[v]https://oxfordbusinessgroup.com/sites/default/files/blog/specialreports/960469/OCP_Agriculture_Africa_Report_2021.pdf

[vi]https://oxfordbusinessgroup.com/sites/default/files/blog/specialreports/960469/OCP_Agriculture_Africa_Report_2021.pdf

[vii] https://disrupt-africa.com/2020/03/crowd-farming-startups-address-vicious-cycle-and-eye-wider-impact/?utm_source=Africa.com&utm_campaign=5c9eb3e690-EMAIL_CAMPAIGN_2019_05_27_09_40_COPY_01&utm_medium=email&utm_term=0_12683c81a6-5c9eb3e690-29147709

[viii]https://africanbusinessmagazine.com/sectors/agriculture/agritech-platforms-revolutionise-farming-investment/?mc_cid=7b7f26d2f9&mc_eid=512a079920.

[ix] https://venturesafrica.com/here-are-11-mission-driven-agritech-startups-in-africa-you-should-know-about/

[x] https://it-online.co.za/2020/12/08/ibm-supports-african-agricultural-start-ups/.

[xi]http://www.africanfarming.net/technology/infrastructure/new-holland-agriculture-launches-farmmate-app-for-farmers.

[xii]http://www.africanfarming.net/technology/infrastructure/new-holland-agriculture-launches-farmmate-app-for-farmers.

[xiii] https://agriculture.newholland.com/apac/en/about-us/whats-on/whats-app.

[xiv] https://www.itnewsafrica.com/2021/01/what-is-the-haller-app-and-how-is-it-assisting-farmers-in-africa/

[xv] https://venturesafrica.com/here-are-11-mission-driven-agritech-startups-in-africa-you-should-know-about/

[xvi] https://venturesafrica.com/here-are-11-mission-driven-agritech-startups-in-africa-you-should-know-about/

[xvii] https://disrupt-africa.com/2020/02/24/ghanas-agripool-is-the-latest-crowd-farming-platform-looking-to-make-an-impact/

[xviii] https://www.digiext.com

[xix] https://www.afrik21.africa/en/ivory-coast-biosave-an-application-to-promote-biofertilizer-production/

[xx] https://www.myagro.org/about-us/story/

[xxi] https://www.myagro.org/about-us/story/

[xxii] https://www.myagro.org/impact/

[xxiii] http://www.africanfarming.net/crops/agriculture/agrorite-com-unveils-digital-platform-for-smallholder-farmers

[xxiv] https://alosfarm.com/why-alosfarm

[xxv] https://www.coldhubs.com

[xxvi]https://disrupt-africa.com/2020/03/crowd-farming-startups-address-vicious-cycle-and-eye-wider-impact/?utm_source=Africa.com&utm_campaign=5c9eb3e690-EMAIL_CAMPAIGN_2019_05_27_09_40_COPY_01&utm_medium=email&utm_term=0_12683c81a6-5c9eb3e690-29147709

[xxvii] http://www.efarmers.ng/en/about-us

[xxviii]https://nipc.gov.ng/2019/08/27/nigerian-agric-tech-startup-ez-farming-clinches-150000-seed-funding/?mc_cid=69fb77359d&mc_eid=5996ec09d0

[xxix] https://ez-farming.com/about

[xxx] https://2feetafrica.com/nigerian-agri-tech-platform-connects-farmers-local-investors/

[xxxi] https://www.itnewsafrica.com/2019/04/farmcrowdy-group-launches-a-agro-commodity-aggregator-platform/

[xxxii] https://www.farmerinsuit.com/about-us/

[xxxiii] https://www.farmerinsuit.com/about-us/

[xxxiv] https://www.farmerinsuit.com.

[xxxv] https://www.growcropsonline.com.

[xxxvi] https://market.requid.com/about

[xxxvii] https://www.thriveagric.com/about-thrive-agric/

[xxxviii] https://techcabal.com/2022/02/22/nigeria-agric-crowdfunding-crash/?utm_source=Newsletter&utm_medium=TC_daily&utm_campaign=rip_what_you_sow&utm_term=2022-02-23

[xxxix] http://afkinsider.com/139303/entrepreneur-links-small-scale-african-farmers-with-venture-capitalists/

[xl]https://www.howwemadeitinafrica.com/kenyan-company-saw-opportunity-link-small-scale-farmers-banks/59201/

[xli]https://www.howwemadeitinafrica.com/kenyan-company-saw-opportunity-link-small-scale-farmers-banks/59201/

[xlii] https://www.farmsmart.co/about-us

[xliii] https://www.hellotractor.com/wp-content/uploads/2018/09/HT-COMMERCIAL-WP.pdf

[xlv] https://ventureburn.com/2021/01/kenyan-insurtech-startup-secures-6-million/

[xlvi] https://www.voanews.com/africa/cryptocurrency-booming-among-kenyan-farmers.

[xlvii]https://www.iol.co.za/business-report/companies/liquid-telecom-partners-with-twiga-foods-to-accelerate-agricultural-transformation-in-kenya-49505997.

[xlviii] https://www.itnewsafrica.com/2020/06/tech-is-essential-in-developing-a-flourishing-agriculture-sector-in-africa/.

[xlix]https://disrupt-africa.com/2020/10/meet-kilimo-fresh-the-tanzanian-agri-tech-startup-that-won-this-years-mest-africa-challenge/?utm_source=Africa.com&utm_campaign=d083ebe328-EMAIL_CAMPAIGN_2019_05_27_09_40_COPY_01&utm_medium=email&utm_term=0_12683c81a6-d083ebe328-29147709.

[l] https://venturesafrica.com/here-are-11-mission-driven-agritech-startups-in-africa-you-should-know-about/

[li] https://livestockwealth.com/how-it-works/

[lii] https://ventureburn.com/2021/04/sa-agritech-launches-innovative-commodities-trading-platform/.

[liii] https://venturesafrica.com/here-are-11-mission-driven-agritech-startups-in-africa-you-should-know-about/

[liv] http://disrupt-africa.com/2018/06/zambias-emsika-helping-farmers-buy-agricultural-inputs/

[lv] https://www.musika.org.zm/about-us/

[lvi] https://venturesafrica.com/how-blockchain-can-help-transform-agriculture-in-africa/

[lvii] https://venturesafrica.com/how-blockchain-can-help-transform-agriculture-in-africa/

[lviii] https://venturesafrica.com/how-blockchain-can-help-transform-agriculture-in-africa/